Electrified Airports Demand Resilient Power

Electrification trends are descending upon U.S. airports.

As adoption of electric vehicles (EVs) rapidly accelerates, other airport campus decarbonization projects are taking off, revving up the transition away from fossil fuel-powered operations.

Increased dependence on the electric grid will heighten resiliency concerns. For many airports, it may no longer be advisable to simply “get more power” from their utility, particularly in light of existing grid reliability concerns.

Prudent airport management calls for special planning efforts. Airports will need to better understand power demand forecasts, assess on-site energy generation and microgrid technologies, determine the likely timing of these changes, and predict their impact on current infrastructure.

Large-Scale Airport Electrification Takes Off

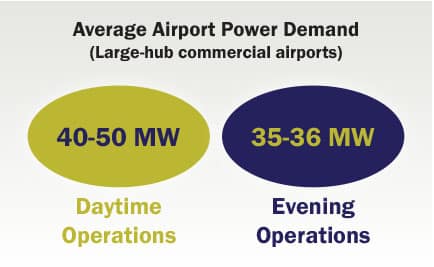

A recent Airport Cooperative Research Program study forecast the cumulative impact of electrification trends over the next 20 years. The conclusion found airport peak electrical loads could double.

As equipment costs trend downward and funding from federal and state programs increases, on-going electrification projects will include:

- EV public chargers throughout airport parking areas and rental car facilities.

- Electric ground service equipment (eGSE) chargers on the airfield.

- Battery electric bus (BEB) and EV chargers for the airport’s fleet of electric light-duty vehicles and buses.

- Pre-conditioned air equipment to power parked aircraft.

- Air- or ground-source heat pumps and central heating equipment.

Not all electrification efforts are voluntary. California’s clean-transportation rules now require that bus-fleet operators purchase zero-emission vehicles (ZEVs). More cities are adopting International Energy Conservation Code requirements to include “EV-ready” charging capacity in newly constructed parking facilities.

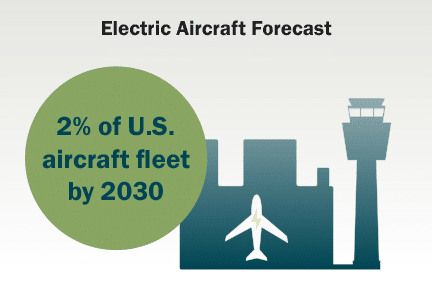

The biggest potential source of new electric demand comes with the greatest uncertainty. About 300 firms are currently developing electric Vertical Takeoff and Landing (eVTOL) aircraft technologies. These lightweight, short-range “air taxi” may become commercially viable for transferring passengers or cargo by 2028 if not sooner.

If eVTOL aircraft eventually operate from commercial airports — or if major airlines and shipping carriers apply this emerging technology and begin operating electric aircraft themselves — airports will need to significantly upgrade their power supply, distribution systems, and back-up generation capabilities.

Source: CALSTART

Limited Grid Capacity, Questionable Reliability, Carbon Neutrality

Distribution and back-up power systems may be strained as electrification trends continue.

Many airports are served by power distribution networks that already operate near capacity. Grid upgrades are expensive and usually take years to complete — in part due to requirements that utilities provide enough power capacity to meet peak demand, regardless of how often full capacity is needed. For airports located within high-density areas, the land necessary to develop new substations or to place new transmission lines may be prohibitively difficult to obtain.

Source: Airports Cooperative Research Program

Even if local utilities can supply the extra capacity, reliability is an increasing concern. Extreme weather events have led to a rise in power outages across the country. In 2020, the United States experienced 14 hurricanes and 11 major storms. That year, the grid suffered the most power interruptions since the U.S. Department of Energy began collecting reliability data in 2013.

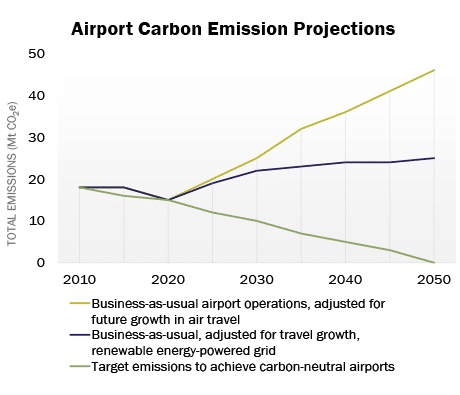

Resiliency measures must also consider sustainability goals. Airports Council International (ACI) set a goal for the world’s airports to reach net-zero carbon emissions by 2050. More than 50 North American airports have responded with carbon-neutrality pledges of their own. How airports choose to expand power capacity must align with long-term decarbonization plans.

Source: Airports Cooperative Research Program

Lower Capital Expenses with Distributed Energy Resources

Airports can add capacity, improve power reliability, and put themselves on paths to achieve their carbon neutrality goals by installing zero-emission distributed energy generation and storage resources.

“Non-wire alternatives” such as solar photovoltaics (PV), fuel cells, and battery storage can provide a more cost-effective, and easily deployed low- or zero-carbon approach. And airports can gradually add power supply to match their facility’s planned load growth.

More than 125 utility projects integrate various distributed energy resources rather than expand transmission and distribution assets, demonstrating better ratepayer value than conventional grid “wire-only” upgrades.

Following this model, distributed energy resources are becoming increasingly common at U.S. airports. To date, more than 20 percent of U.S. airports have some type of solar PV installation. Battery energy storage systems can be found at San Diego International Airport and John F. Kennedy International Airport.

Source: Airport Council International

As power demand grows, options for increased capacity include larger-scale PV arrays coupled with battery energy storage, fuel cells, and traditional back-up generators that perhaps run on renewable natural gas or biodiesel. On-site renewable power coupled with storage can offset, augment or outright replace utility power for a limited length of time.

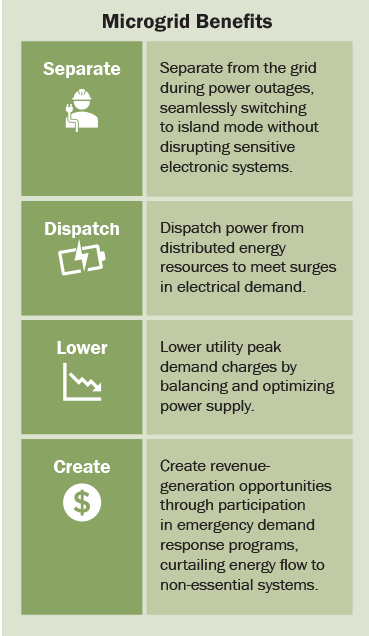

Innovative airports such as Pittsburgh International Airport are going an extra step by developing their own microgrids. These self-sufficient energy systems incorporate the airport’s power assets, ensuring operational resilience by allowing the campus to disconnect from the grid during utility outages.

Planning the Best Pathway to Resilient Electrification

Until now, electrification initiatives have occurred at the discretion of proactive airports. Moving forward, airports will have to react as stakeholder demand and new regulations lead to the rapid expansion of EV charging infrastructure and other emission-reduction measures.

Many pathways exist to resilient electrification. Airports that properly integrate distributed energy resources can scale up new sources of power, while remaining agile and adaptable to evolving regulatory environments, tariffs, technologies and incentives.

Electrical master plans can help airports forecast stakeholder and internal adoption of EVs, eGSE, BEBs, and other modes of electric mobility. Once charging demand is more accurately forecasted, airport planners can more clearly determine new electric capacity and other infrastructure upgrades necessary across the campus.

Planning exercises can also help airports identify public-private partnership that leverage alternative sources of capital and offer expertise in owning and operating complex energy assets and systems. Airports can shift risk to Energy as a Service firms that manage, monetize or maintain on-site distributed energy resources. In return, airports simply pay for the power they consume.

With demand for resilient new power sources unlikely to taper off, long-term electrical master planning has become more important than ever.

Featured photo courtesy of The Hawaii Department of Transportation.