Inflation Reduction Act Brings Clean Energy Within Reach

Starting this year, U.S. energy consumers and businesses can take advantage of significant financial incentives made possible through the 2022 Inflation Reduction Act (IRA).

Notable changes to the federal tax code include:

- Larger tax credits for renewable energy, clean transportation, and energy efficiency projects

- Long-term certainty — certain credits will be available through 2032 or until the electric power sector achieves a 75-percent reduction in carbon emissions

- Broader eligibility rules will cover battery energy storage systems, microgrids, zero-emission vehicles, charging infrastructure, and hydrogen generation facilities, among others

Previously, the Investment Tax Credit (ITC) and Production Tax Credit (PTC) applied only to tax-paying entities or investors with sizable tax liabilities. Moving forward, these incentives can be leveraged by tax-exempt organizations as well. Beneficiaries will include universities, municipalities, hospitals, and aviation and marine port authorities.

This article summarizes only a portion of the IRA’s many provisions. Readers are encouraged to consult a tax professional to best understand their eligibility and to maximize their financial opportunities.

Expanded Eligibility for Clean Energy Incentives

The IRA breaks with decades of energy policy.

For years, the federal government relied on tax credits like the ITC or PTC to spur clean energy adoption. These policies, however, limited who could benefit. Only project owners or developers with tax income were able to fully take advantage of the credit value.

A common work around has involved investment banks who provide the upfront capital and, in return, take the credit for themselves. By involving tax equity investors, this generally reduces the credit’s value, diminishing the overall impact on clean energy adoption.

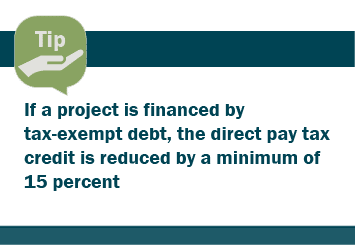

A new “direct pay” option allows tax-exempt entities who install their own clean energy systems to receive the credit as a cash refund from the Internal Revenue Service (IRS). Direct pay can apply to 501(c)(3) organizations, state agencies, local municipalities, tribal governments, and co-op utilities.

Alternatively, the IRA offers greater flexibility for transferring credits. The IRA allows project owners or developers to sell the credit to anyone with a tax liability — regardless of whether the buyer is a project investor. Instead of sharing a portion of the credit with investors, analysts predict this “transferability” option should retain more of the credit’s value, with buyers perhaps limiting their payment to 5-7 percent.

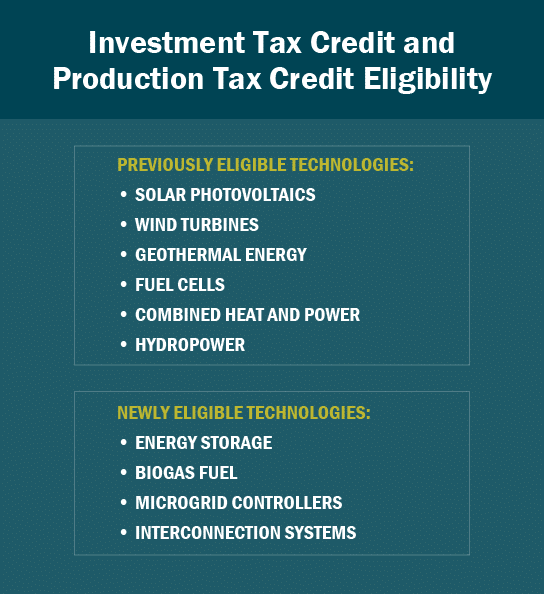

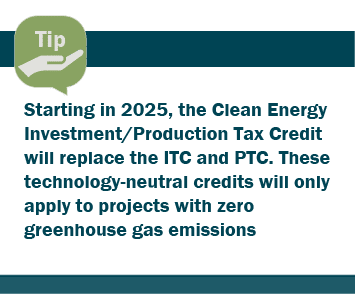

Renewable Energy Tax Credits

After years of Congressional funding cuts, the IRA now extends the ITC and PTC for up to a decade. It also establishes various pathways to increase each credit’s maximum value. While both credits may apply to a given project, the applicant can only choose one of these credit options.

The ITC lowers upfront installation costs for applicable energy projects. At minimum, the credit is worth 30 percent of relevant project costs — so long as the project pays prevailing wages during construction and fulfills apprenticeship requirements.

The PTC offers system owners an ongoing credit based on the amount of energy produced and sold (a minimum value of 1.5 cents per kWh). In general, the PTC is most beneficial for larger projects.

Bonus credits— each worth an additional 10-percent value — are available if the project is:

- Located in low-income communities or on tribal land

- Sited on a brownfield site or within an area considered an “energy community,” meaning the local workforce is overcoming job losses due to a recently closed coal mine or coal-fired power plant

- Sourcing supplies from domestic steel, iron, or component manufacturing facilities

Microgrid Tax Credits

The IRA acknowledges transitioning to a low-carbon economy involves much more than increasing renewable energy. Accordingly, the legislation also expands tax credit eligibility to a wide range of distributed energy resources.

Until now, the ITC only applied to battery storage projects if batteries were paired with solar PV. Moving forward, standalone storage can also qualify.

If a project is connecting to the grid, the IRA can help lower costs for power transmission or distribution infrastructure. An “interconnection property” can qualify for the ITC so long as the facility’s net power output does not exceed 5 Megawatts (MW).

If the project is part of a microgrid, certain technology costs can be included in the overall ITC value. The legislation specifically clarifies that eligibility applies to the microgrid controller — the component that determines how energy flows among distributed energy resources, balancing power delivery and consumption.

Altogether, these IRA provisions are expected to lower the cost to install energy generation, storage, and transmission infrastructure. By lowering the costs of these energy assets, which comprise the critical components of a microgrid, the IRA is expected to drive further adoption of microgrids — particularly in areas with limited power supplies and higher energy costs.

Zero-Emission Fleet Incentives

The ITC and PTC are not the only tax credits worth exploring. The IRA creates a new credit for vehicle fleets that transition to zero-emission alternatives.

Vehicle purchases can qualify for a 30-percent tax deduction. The so-called “45W credit” maxes out at $40,000 for most medium- and heavy-duty vehicles or $7,500 for light-duty vehicles. Fleet operators without tax liabilities can use the “direct pay” option explained earlier.

Most medium-and heavy-duty zero-emission vehicles qualify for tax credits worth up to $40,000

Stacking incentives will become an attractive strategy. The 45W credit can be combined with the ITC as well as other credits that lower upfront costs for charging infrastructure, hydrogen-production facilities, or distributed energy resources. Section 1304, for example, offers a credit for charging infrastructure installed within low-income communities, valued up to $100,000 per installation.

The IRA also provides billions of dollars in new grant funding. Combined with existing federal, state and utility incentives, fleet operators can significantly lower costs to transition to battery-electric or hydrogen fuel-cell electric vehicles.

Energy Efficiency Tax Incentives

The IRA establishes new incentives for deep energy efficiency improvements integrated within new construction or building retrofit projects.

An existing deduction, known as 179D, offers a credit of $1.80 per square foot for new construction projects that demonstrate energy savings of 50 percent or more.

The IRA makes several revisions to 179D:

- Expands eligibility to retrofit projects

- Increases the maximum deduction to $5.00 per square foot

- Lowers the eligibility threshold to projects that achieve savings of at least 25 percent

The IRS previously clarified that governmental entities can take advantage of 179D by allocating the deduction to a qualified third party, such as the project design team. The IRA builds upon this arrangement, establishing that any tax-exempt organization — governmental or otherwise — can pass along the credit, effectively lowering the overall project cost.

The 179D revisions offer tremendous opportunities to shorten the payback of energy efficiency design or to expand a project’s scope. Some public universities are recognizing these benefits, revising Requests for Proposal language with suggestions for how design partners should negotiate the shared tax credit’s value.

Transforming the Energy Economy

In the weeks ahead, look for new regulations to clarify how the IRS and other federal agencies will implement the IRA’s various provisions.

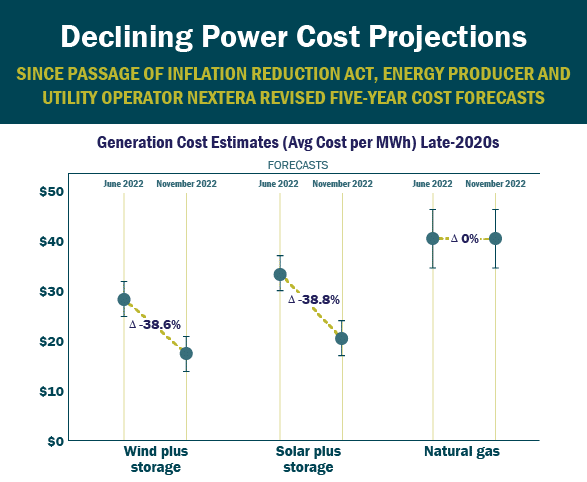

While some final details need to be sorted out, the overall picture is clear: the IRA will have a transformative impact on how energy is produced and consumed in the United States. Expect record-setting levels of investment in renewable energy, battery energy storage systems, energy efficiency, and zero-emission vehicles.

After years of federal incentives benefitting mostly investors with sizable tax liabilities, the IRA will expand clean energy adoption across a much wider range of energy consumers. The benefits will flow not only to the agencies, organizations and businesses who are improving their facilities by lowering costs and enhancing their resiliency. We all stand to benefit from a cleaner, more sustainable energy economy.

This article originally appeared in METRO Magazine.